Creating and Executing a Competitive Positioning Strategy (Part 1)

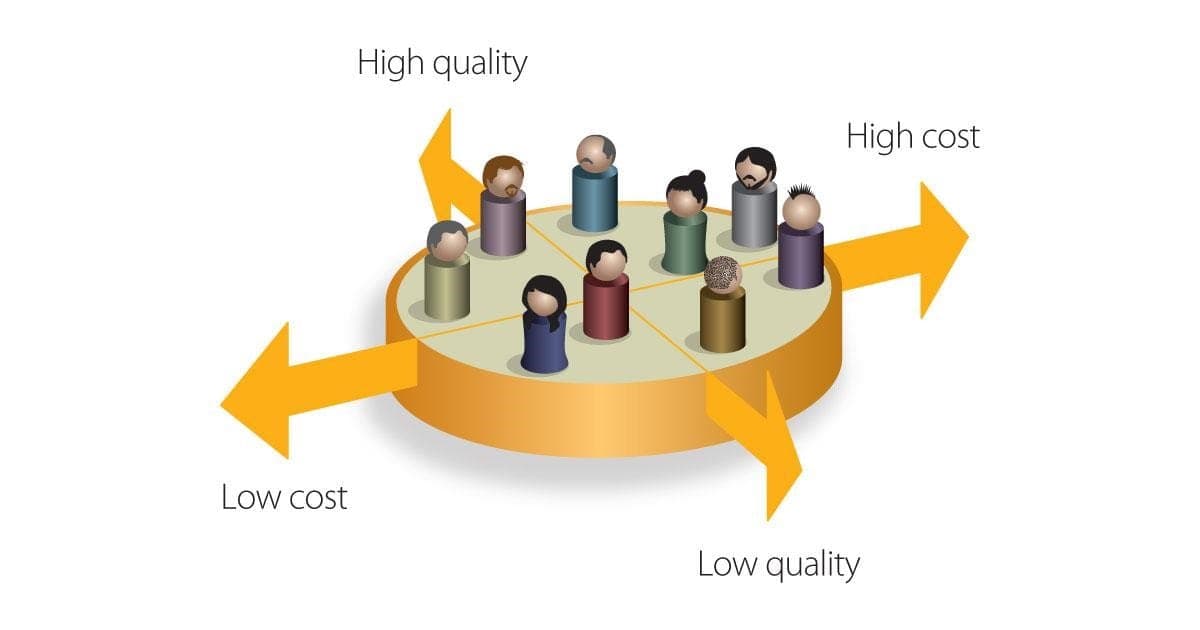

In B2B markets there are typically three ways to compete: quality of products and services, price, and breadth of offering (i.e., a one-stop shop). In each scenario, value is delivered by either offering the best products and services, offering the cheapest products and services, or offering the broadest range of products and services. There is no correct or incorrect strategy, but there is a universal business fact that has stood the test of time: any company can provide customer value by delivering customers high quality, low price, or breadth of offering, …but it is impossible to successfully provide all three. Companies must choose a competitive positioning strategy, align the organization to deliver on the value promise, and measure performance against the competition.

Figure 1

Competitive Positioning Strategy Process

As illustrated in Figure 1, this process is conducted in 3 steps and repeated as needed:

- Step 1 – Analysis and Planning

- Assessment of the Competitive Environment

- Planning and Developing a Competitive Positioning Strategy

- Step 2 – Alignment & Implementation/Execution

- Organizational Alignment

- Implementation and Execution of Strategy

- Step 3 – Measure Success and Review Competitive Environment

- Measure Results

- Re-Assess Competition

- Repeat Process Based on Results of Step 3

This process creates the organizational culture that drives strategic success.

Developing a Competitive Positioning Strategy

In developing a winning value position, one must first understand two key pieces of information (1) what has the highest likelihood of success based on the current and future market needs/conditions and (2) what differentiating capabilities your organization currently has or can develop over time. In most cases, organizations have a better understanding of their internal capabilities and competitive advantages versus the understanding of market needs, pain points, and associated opportunities. The logical place to begin the process is by determining answers to critical questions, such as those listed below, though targeted market research.

- Competitive Assessment

- Is the market underserved in any of the three areas of value creation (quality of products and services, price, and breadth of offering)?

- Are suppliers profitable?

- Is the industry consolidating? Why?

- Competitive Positioning

- How well are competitors positioned?

Figure 2 below is an example of this analysis. The diagonal line represents quality and price equilibrium; companies that fall along this diagonal line are delivering quality consistent with their pricing (or delivering equivalent value). In this particular example, Zeta is closest to value equilibrium as they are lower priced, but also deliver less quality than others. Gamma is the highest-priced competitor, but delivers the lowest quality. Alpha delivers high quality at a relatively low price, thus offering the highest overall value to customers. Alpha’s competitive position strongly suggests they can increase pricing and maintain share.

Figure 2

Competitive Positioning Analysis

- Customer Needs Assessment

- Are current customers’ needs being met?

- What are the customer pain points that if addressed could create value?

- How is the market changing, and what opportunities will the changes create?

- What are the critical areas of improvement that will create the most value?

- Are you advantaged or disadvantaged versus competition on product and service attributes that drive overall satisfaction?

A key deliverable in this area of competitive research is what we refer to as a “gap analysis”, which is an attribute-level analysis of the performance gap (either positive or negative) between your company’s performance versus competition. This analysis can be completed in aggregate (including all competitors) as well as for specific competitors. The insight delivered in this competitive gap analysis is extremely valuable in understanding your specific competitive strengths and weaknesses, as well as showing where you are advantaged and disadvantaged relative to competition. An example of this analysis is seen below in Figure 3.

Figure 3

The above chart shows the difference in performance (or performance gaps) of “Competitor A” versus your company. Red bars indicate attributes where your company’s performance is behind the competition, while blue bars indicate performance ahead of the competition. . The same comparative analysis can be performed for each each competitor.

Possessing a solid understanding of your company’s performance as well as the competitor’s performance on critical attributes provides a clear picture of how well you compete on the key drivers of customer satisfaction and value.

Developing this depth of competitive intelligence through these proven research methods can create an invaluable competitive advantage, providing unparalleled insight when creating a competitive strategy in Step 1 of the Competitive Positioning Strategy Process (Figure 4).

Figure 4

Competitive Positioning Strategy Process (Step 1)

Research, Assess and Design

In my next blog, I will discuss Step 2 and Step 3 of the Competitive Positioning Strategy process.

- Step 2 – Alignment & Implementation/Execution

- Organizational Alignment

- Implementation and Execution of Strategy

- Step 3 – Measure Success and Review Competitive Environment

- Measure Results

- Re-Assess Competition